HRA Deduction Calculator

Calculate your House Rent Allowance exemption under Income Tax

Your HRA Exemption Results

Calculation Breakdown

House Rent Allowance (HRA) is one of the most important components of salary packages for salaried individuals in many countries where rent relief forms part of tax policy. Understanding HRA deduction calculation—how it works, who qualifies, and the optimal way to claim it—can significantly reduce taxable income and increase disposable income. This article provides an in-depth, step-by-step exploration of HRA calculation: its history, objectives, practical computations, regional and state-level implications, success stories, governance and policy framework, implementation challenges, comparisons with other tax relief measures, and the likely evolution of HRA benefits in the future.

Introduction: Why HRA Deduction Calculation Matters

For millions of working professionals, HRA is a recurring topic each financial year. At its surface, the HRA deduction calculation appears straightforward: it helps taxpayers who live in rented accommodation reduce their taxable income. In practice, however, the calculation interacts with components such as basic salary, city of residence, actual rent paid, and other allowances. The nuance of HRA deduction lies in its conditional formulas, documentation requirements, and the strategic choices taxpayers can make to maximize tax efficiency.

A clear, precise understanding of HR calculation not only helps individuals file accurate returns but also equips them to make informed housing and employment decisions—such as negotiating salary structures, choosing where to live, and planning long-term finances. This guide will walk you through everything you need to know about HRA calculation, illustrated with examples and practical tips.

A Brief History of HRA and Its Policy Foundations

HRA originated as a targeted tax incentive: policymakers wanted to ease the financial burden of urban housing for salaried employees and provide a structured way to account for rent in income tax assessments. Over time, the HRA calculation methodology evolved to incorporate city-wise differences (recognizing the higher housing costs in urban centers), and to encourage transparency by requiring proofs such as rent receipts and landlord information.

Historically, HRA calculation has been part of broader attempts to balance fiscal policy and social welfare: the state recognizes rent as a genuine expense for many households and allows part of that expense to be excluded from taxable salary. By designing the HRA calculation formula carefully—using elements like actual HRA received, rent paid, and a fraction of salary—governments have aimed to reduce misuse while still delivering relief.

Objectives Behind HRA Deduction Calculation

Understanding the objectives clarifies why the HRA has its current structure:

- Relief from housing costs: To alleviate the tax burden on employees who must pay rent.

- Progressive relief by location: To recognize higher housing costs in metro and urban centers through different percentage ceilings in the calculation.

- Simplicity with safeguards: To create a formulaic deduction that’s straightforward yet guarded by documentation to prevent misuse.

- Administrative efficiency: The HRA is integrated into payroll and tax filing systems for easier compliance.

These objectives influence the rules and documentation requirements that accompany any HRA deduction calculation.

The Core Formula — How HRA Calculation Works

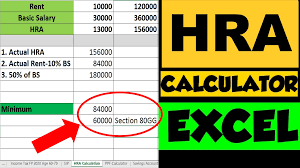

While specifics may vary by jurisdiction, the canonical approach to HRA calculation follows a three-part comparison principle. The deductible HRA amount is the least of the following three values:

- Actual HRA received from the employer.

- Actual rent paid minus 10% (or another specified percentage) of basic salary (sometimes including dearness allowance).

- A fixed percentage (often 40% for non-metro cities and 50% for metro cities) of basic salary plus dearness allowance (where applicable).

Thus, the HRA is essentially: Deduction = min(Actual HRA received, Rent paid − 10% of basic salary, 40% or 50% of salary as per city). The presence of a minimum-of-three rule keeps the HRA conservative and objective.

Example of HRA Calculation (Illustrative)

Suppose an employee earns a basic salary of $40,000 annually, receives an HRA of $12,000 annually, and pays rent of $15,000 annually while residing in a metro city where the applicable percentage is 50%.

Compute the three values:

- Actual HRA received = $12,000.

- Rent paid − 10% of basic salary = $15,000 − $4,000 = $11,000.

- 50% of basic salary = $20,000.

HRA calculation yields the least of these three: min($12,000, $11,000, $20,000) = $11,000. Therefore, the HRA deduction for that year is $11,000.

This example demonstrates how rent outlays combined with salary structure determine the final HRA.

Components That Affect HRA Calculation

Several components modify the effective benefit from the HRA deduction calculation:

- Basic salary and dearness allowance (DA): Some jurisdictions include DA in salary for HRA calculation; others do not. HRA deduction calculation often depends on the declared basic and DA figures.

- Actual HRA received: Employees who do not receive HRA as a specific component of salary cannot claim the deduction under the typical formula.

- Locality (metro vs non-metro): The city of residence affects the percentage ceiling used in the HRA deduction calculation.

- Eligibility documentation: Receipts, lease agreements, and landlord PAN or tax identifiers may be necessary to substantiate rent paid for the HRA.

- Shared accommodation and subletting: Rules may vary about whether multiple occupants can claim HRA deductions proportionally, affecting the HRA deduction calculation when more than one tenant contributes to rent.

Each of these elements needs attention when computing or validating an HRA deduction calculation.

Documentation and Compliance for HRA Deduction Calculation

Beyond computation, ensuring compliance is essential. Employers typically require tenants to furnish rent receipts and landlord details during salary processing to apply the HRA calculation in monthly payroll (under tax-saving declarations). At tax filing, taxpayers must retain originals or scanned copies of rent receipts, rental agreements, and where required, the landlord’s tax ID.

In some jurisdictions, if annual rent exceeds a given threshold, additional steps such as providing landlord PAN (or equivalent) are required for the HRA deduction calculation to be accepted without triggering tax notices. Failure to maintain proper documentation can lead to disallowances or adjustments in a tax assessment.

Practical Strategies to Optimize HRA Calculation

Sound tax planning can make the HRA work harder for taxpayers. Here are practical strategies:

- Structure salary effectively: Increasing the HRA component within permissible employer policies can raise the possible HRA deduction calculation ceiling.

- Maintain clear rent receipts: Organized receipts and a rental agreement help in seamless validation and application of the HRA deduction calculation.

- Leverage joint claims wisely: When spouses both earn and pay rent, coordinating HRA claims across both incomes can be advantageous but must be supported by payment records.

- Consider city status: If possible, living in a rated metro vs non-metro affects the HRA deduction calculation percentage and can materially change outcomes.

- Time rent payments: Since HRA is typically annual, planning rent payments (especially for those moving mid-year) can influence the deductible amount.

These tactics should always be balanced with legal and ethical compliance; artificial manipulations to inflate HRA deduction calculation benefits may invite scrutiny.

State-Level and Regional Impact on HRA

The HRA deduction calculation does not exist in a vacuum. Its effect depends on local housing markets, state tax policies, and broader fiscal frameworks.

Urban Centers vs Peripheral Regions

Metropolitan regions with higher rents make the HRA calculation more valuable because the percentage threshold (often 50%) yields larger allowable deductions. Conversely, in smaller towns where housing costs are lower, HRA deduction calculation may deliver modest savings.

State-Level Policy Interactions

State policies related to housing subsidies, rent control regulations, and state-level tax surcharges can alter the net benefit derived from an HRA calculation. For instance, state-provided rental assistance programs or housing benefits for certain groups can complement the HRA deduction calculation, reducing overall housing expenditure.

Employment Patterns and Migration

High migration to urban centers for employment increases demand for rental housing. The HRA deduction calculation becomes a significant component of financial planning for migrant workers, affecting decisions like commuting versus relocation.

Social and Economic Objectives Linked to HRA Deduction Calculation

Beyond immediate tax relief, HRA deduction calculation supports broader socioeconomic goals:

- Labor mobility: By partially offsetting rental costs, HRA helps workers relocate for better employment opportunities.

- Urban housing demand signaling: HRA deduction calculation implicitly acknowledges and accommodates urban housing demand by offering relief proportional to city-level costs.

- Support to lower-income earners: Where HRA rules account for actual rent paid, lower-wage workers who live in rented housing can benefit from measurable tax relief.

- Complement to welfare programs: HRA deduction calculation works alongside social welfare initiatives, including housing subsidies and women’s empowerment schemes that may prioritize safe and affordable housing.

These objectives highlight the multi-dimensional impact of HRA deduction calculation as more than a mere tax instrument.

Success Stories and Case Studies

Several illustrative success stories demonstrate the power of a well-applied HRA deduction calculation.

Case Study 1: Young Professional in a Metro City

A young professional relocating to a metro city negotiated a salary package with a higher HRA percentage. By submitting prompt rent receipts and properly applying the HRA deduction calculation, the professional reduced taxable income appreciably, making the relocation financially viable for the first year.

Case Study 2: Dual-Income Household Sharing Rent

A married couple, both salaried, lived in rented accommodation and split rent payments. By coordinating claims and submitting documentation, they leveraged the HRA deduction calculation across both incomes, maximizing combined tax savings and improving household finances.

Case Study 3: Migrant Worker from Rural Region

A migrant worker who moved to an urban industrial hub relied on HRA deduction calculation to lower living costs. Combined with state-level rental assistance, the effective burden of rent decreased, improving the worker’s ability to save and remit money back to their family in rural areas.

These real-world examples show how the HRA deduction calculation, when used correctly, can facilitate mobility, support households, and improve financial outcomes.

Challenges in Implementation and Common Pitfalls

While HRA deduction calculation is beneficial, taxpayers and administrators face several challenges:

- Documentation lapses: Missing rent receipts or incomplete rental agreements are common and can nullify an otherwise valid HRA deduction calculation.

- Informal rental arrangements: In many regions, rental payments are cash-based without formal receipts, making it difficult to support HRA deduction calculation claims.

- Discrepancy in salary components: Employers and employees sometimes disagree on what constitutes basic salary or DA, which are key to HRA deduction calculation.

- Tax avoidance attempts: Authorities must guard against schemes that artificially inflate HRA to reduce taxable income—this complicates straightforward HRA deduction calculation administration.

- Regulatory changes: Periodic changes in tax law can alter components used in the HRA deduction calculation, requiring employees to stay updated.

Addressing these challenges requires proactive compliance by taxpayers, thoughtful payroll administration by employers, and clear communication from tax authorities.

Comparisons: HRA Deduction Calculation vs Alternative Housing Benefits

Several alternatives and complements to HRA exist, and understanding these helps taxpayers choose the best route.

HRA vs Standard Deduction

A standard deduction is a flat reduction in taxable income available to many taxpayers regardless of expenses. HRA deduction calculation, unlike a standard deduction, is tied to actual housing expense and is therefore often more beneficial for those paying significant rent.

HRA vs Home Loan Interest and Principal Repayment Benefits

Homeowners benefit from mortgage-related deductions such as interest and principal repayments. HRA deduction calculation caters to tenants—thus HRA and home loan benefits are not substitutes but possible sequential benefits during a lifetime (renting first, then purchasing).

HRA vs Rent Subsidies and Welfare Programs

State welfare programs might offer direct rental subsidies targeted at low-income groups. HRA deduction calculation is a tax-based incentive primarily for salaried taxpayers. In many cases, combining social subsidies and HRA deduction calculation yields the best net outcome.

By comparing these instruments, taxpayers can align decisions (rent vs buy, benefit claims) with long-term financial goals.

Policy Framework: Governance and Oversight

HRA deduction calculation sits within a larger tax policy architecture that balances revenue needs with social objectives. Key governance features typically include:

- Clear statutory limits on HRA deductions and defined computation methods.

- Documentation requirements to substantiate claims.

- Periodic audits and employer reporting responsibilities to ensure compliance.

- Public guidance and FAQs from tax authorities to improve taxpayer awareness about HRA deduction calculation.

Sound oversight prevents misuse and ensures that HRA deduction calculation serves its intended fiscal and social roles.

Technological and Administrative Innovations

Recently, payroll software and tax filing platforms have automated HRA deduction calculation and related validations. Digital rent receipts, bank payment records, and e-signatures for rental agreements have simplified compliance and reduced the friction associated with traditional paper submissions. These innovations enhance the accuracy of HRA deduction calculation and decrease disputes during tax assessments.

Equity Considerations: Who Benefits Most?

HRA deduction calculation typically benefits salaried individuals living in rented accommodation—most often younger workers, migrants, and professionals in urban centers. However, the distributional impact depends on salary levels and rent amounts: higher-income earners in expensive cities may gain larger absolute tax savings, while lower-income groups rely more on targeted welfare benefits. Policy debates around HRA deduction calculation sometimes center on whether the tax instrument should be tailored more towards the needy or remain broad-based.

Future Prospects and Reform Ideas

Tax policy is dynamic; the HRA deduction calculation could change to better reflect contemporary housing patterns and social priorities. Potential future directions include:

- Targeted ceilings: Introducing income-based or asset-based limits to ensure HRA deduction calculation benefits those who need it most.

- Digital documentation mandates: Requiring digital rent receipts and bank transfers for easier validation of HRA deduction calculation claims.

- Integration with rental market data: Linking HRA deduction calculation standards to region-specific rental indices to make relief more responsive to actual market conditions.

- Enhanced support for vulnerable groups: Combining HRA deduction calculation with direct rental assistance for women-headed households or low-income migrants.

- Simplification: Reducing complexity by refining the calculation to fewer variables without compromising fairness.

These reforms can increase both fairness and administrative efficiency in how HRA deduction calculation operates.

Comparative International Perspective

While the specific term “HRA deduction calculation” might be tied to certain tax systems, many countries offer equivalent relief for renters. Comparative policy analysis reveals a spectrum—from flat renter tax credits to sophisticated deduction formulas that account for regional rental cost variations. Learning from international best practices can help refine local HRA deduction calculation frameworks to ensure they are equitable and cost-effective.

Practical Checklist for Claiming HRA Using the HRA Deduction Calculation

To make the application of HRA deduction calculation smooth, consider this practical checklist:

- Verify that HRA is explicitly part of your salary structure.

- Maintain monthly rent receipts with date, amount, and landlord signature.

- Keep a copy of the rent agreement specifying duration and rent.

- If applicable, obtain landlord tax ID or PAN details as required by law.

- Reconcile payroll HRA entries with annual form 16 or equivalent.

- Use the correct city classification (metro/non-metro) for the HRA deduction calculation.

- Retain proofs of payment (bank transfers or canceled cheques) where possible.

- Coordinate claims if sharing rent with another salaried individual.

Following this checklist reduces the risk of disputes during tax review or audit and ensures correct HRA deduction calculation.

Common Misconceptions about HRA Deduction Calculation

There are persistent misconceptions that can mislead taxpayers:

- Misconception: Rent paid without receipts cannot be claimed.

Reality: While receipts are best, some systems accept alternate proof if accompanied by credible evidence—however, this varies by jurisdiction and weak proof increases audit risk. - Misconception: HRA deduction calculation only applies if you receive HRA every month.

Reality: If HRA is part of your salary structure and documented for the year, deductions may apply on an annual basis, though employers usually process HRA monthly. - Misconception: You can claim full rent as HRA deduction.

Reality: HRA deduction calculation caps the deductible amount using the min-of-three rule; full rent is often not deductible.

Understanding facts versus myths ensures correct application of the HRA deduction calculation.

Conclusion: Making HRA Calculation Work for You

HRA deduction calculation is a powerful, established instrument that reduces the tax burden for renters and makes urban employment mobility more affordable. A correct HRA requires awareness of salary structure, locality classification, precise documentation, and prudent tax planning. By mastering the formula and following compliance best practices, taxpayers can confidently claim HRA benefits and improve their annual financial outcomes.

As housing markets evolve and digital compliance becomes standard, the HRA deduction calculation is likely to become more streamlined. Policymakers and administrators will need to balance revenue protection with social equity to ensure that HRA deduction calculation remains both fair and effective.

Frequently Asked Questions (FAQs)