Monthly HRA Calculator

Calculate your monthly House Rent Allowance exemption

Your Monthly HRA Exemption

Monthly Calculation Breakdown

House Rent Allowance (HRA) is one of the most important components of salary for millions of salaried households. For those who rent accommodation, understanding how HRA works — and using an accurate hra calculator monthly — can mean better tax planning, smarter budgeting, and fewer surprises at tax time. This long-form guide explains HRA from the ground up: the legal basis, how monthly and annual exemptions are computed, practical implementation, state-level implications, real success stories, common challenges, comparisons with other housing benefits, and future prospects. Throughout, you’ll find clear examples, strategic tips, and an FAQ section to resolve the most common doubts.

Note: Where relevant, I reference primary guidance and authoritative calculator tools from the Income Tax Department and well-known tax/finance platforms to help you verify rules and run your own calculations. Income Tax India+1

What is HRA and why a dedicated hra calculator monthly matters

House Rent Allowance (HRA) is a component of salary paid by employers to help employees meet the cost of renting accommodation. While part of HRA is taxable, a portion may be exempt under the income tax rules — but the exempt amount depends on a formula that considers salary elements, the rent you pay, and whether you live in a metro city. Because there are multiple variables and monthly changes in rent or salary components, an hra calculator monthly is especially useful: it helps you compute tax-free HRA on a monthly basis, track changes, and estimate the taxable portion that must be included in payroll or annual tax returns. Official tools and many trusted private calculators implement the same rule set, making monthly calculation straightforward and auditable. Income Tax India+1

A short history: how HRA developed and its tax position

HRA was introduced as a salaried allowance to help employees meet rental costs where government-provided housing or owner-occupied housing wasn’t available. Over decades the income tax system formalised the rules for HRA exemption under Section 10(13A) (and associated rules), requiring taxpayers to compute the exempt portion using a clearly defined minimum-of-three-values formula.

In recent years, the tax environment has changed with the introduction of an optional “new tax regime” and updates to reporting requirements. The key result: HRA exemption remains part of the old tax regime under Section 10(13A), but it is not available under the new tax regime (Section 115BAC). This means taxpayers choosing the new regime cannot claim HRA exemption — the entire HRA component becomes taxable — making monthly HRA calculations critical when comparing regimes. For authoritative clarity, government FAQs confirm the absence of HRA exemption in the new regime. Income Tax Department+1

The objective behind HRA exemption

The tax exemption for HRA aims to:

- Relieve the tax burden of salaried individuals who live in rented accommodation.

- Encourage formal documentation of rent payments and transparency in taxable income.

- Provide a standard method across employers and payroll systems to compute an equitable exemption based on ability to pay (salary) and actual rental expenditure.

A reliable hra calculator monthly serves each of these objectives: it ensures consistent computations, produces month-by-month records for the employer and employee, and supports accurate payroll tax deduction.

The HRA exemption formula (monthly and annual application)

The HRA exemption is the least of the following three amounts:

- Actual HRA received from the employer (annualized).

- Rent paid in excess of 10% of salary (annualized) — that is, (Total Rent Paid for the year) − 10% of (Basic + DA if DA is considered for retirement benefits).

- 50% of salary (Basic + DA when applicable) for employees living in metro cities; 40% for employees living in non-metro cities (annualized). Metro cities commonly defined are: Mumbai, Delhi, Chennai, and Kolkata. Income Tax India+1

Because the formula is conventionally presented on an annual basis, an hra calculator monthly converts monthly inputs (monthly basic, monthly DA if any, monthly rent, and monthly HRA received) into annual figures, computes the three values, and then presents both annual and prorated monthly exempt amounts. That’s why monthly calculators are practical — they let you see the monthly exempt portion and the taxable HRA that should be added to your payroll or annual tax return.

Step-by-step monthly calculation with an example

To make the calculation tangible, here is a concise step-by-step process you can use with any hra calculator monthly:

- Take monthly inputs: monthly basic salary, monthly Dearness Allowance (DA) if treated as part of salary for retirement, monthly HRA received, and monthly rent paid.

- Annualize each input by multiplying by 12 (unless you want to compute exemption for a part-year — a good hra calculator monthly offers partial-year prorating).

- Compute the three amounts:

- Actual HRA received (annual).

- Rent paid (annual) − 10% of (Basic + DA) (annual).

- 50% or 40% of (Basic + DA) (annual) depending on metro vs non-metro.

- The exempt amount is the minimum of the above three. Divide by 12 to get the monthly exempt portion.

- Taxable HRA monthly = Monthly HRA received − Monthly exempt portion (if positive).

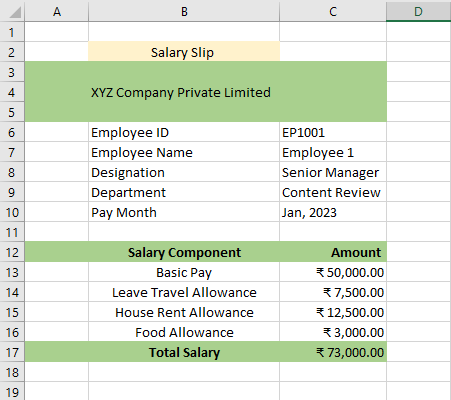

Example: Suppose monthly Basic = ₹40,000; DA (counted) = ₹5,000; HRA received monthly = ₹10,000; rent paid monthly = ₹20,000; city = metro. Annual figures: Basic + DA = ₹540,000; HRA received = ₹120,000; Rent paid = ₹240,000. Three amounts: actual HRA = ₹120,000; rent paid − 10% salary = ₹240,000 − ₹54,000 = ₹186,000; 50% of salary = ₹270,000. Minimum = ₹120,000 → annual exemption = ₹120,000; monthly exempt = ₹10,000, and taxable HRA = ₹0 (in this example). Recreate this in any good hra calculator monthly and test variations. Many calculators (including government tool) provide fields exactly for these values. Income Tax India+1

Monthly vs annual computation: why both matter

Although tax law defines HRA exemption on an annual basis, practical payroll and personal finance require monthly granularity:

- Employers often deduct TDS (tax at source) monthly. A monthly hra calculator monthly helps set correct monthly taxable salary and TDS.

- Rent and salary can change during the year — a monthly calculator can pro-rate exemptions for periods of change.

- Employees moving cities mid-year (metro ↔ non-metro) need prorated exemption calculations, which a monthly tool simplifies.

- For audits or future tax assessments, month-by-month rent receipts and calculations create a tidy evidence trail.

Using a monthly calculator prevents surprises at year-end and supports cashflow planning when taxable HRA increases or decreases.

Documentation and proof: what you need when claiming HRA

To substantiate HRA exemption, employers and tax authorities typically require:

- Rent receipts (monthly) showing landlord name, PAN if annual rent > ₹1,00,000, and mode of payment (bank transfer, cheque).

- A valid rent agreement (especially if tenancy is long-term or landlord is a family member).

- Employer’s HRA declaration (employer-specific forms).

- For payments to family members (parents, spouse), proof of regular rent payment and an agreement is often required to avoid scrutiny.

Recent changes in the ITR and employer reporting mean the tax department seeks more detail for exemption claims — making a running output from an hra calculator monthly plus digital rent records a helpful dossier. HDFC Life+1

State-level impact and regional differences

While the HRA formula is centralised under income tax rules, state-level realities shape how HRA interacts with local housing markets, landlord behaviour, and social policies:

- Metro concentration: High rent levels in metros (Mumbai, Delhi, Chennai, Kolkata) mean many employees reach the 50% salary ceiling sooner; HRA exemptions in metros therefore play a bigger role in tax planning for urban migrants.

- State rental markets: In states with rapidly rising rents (parts of Maharashtra, Karnataka), HRA often aligns closely with actual rent paid so the rent − 10% salary component becomes decisive.

- Landlord registration and PAN rules: Several states enforce or encourage formal reporting of rental income. If annual rent to a landlord exceeds ₹1,00,000, PAN details must be furnished — a detail many hra calculator monthly tools highlight as a compliance trigger. HDFC Life+1

Policy linkages: social welfare initiatives such as affordable rental housing schemes, urban redevelopment, and state-level rental laws influence the demand-supply dynamics of rental housing. Where government schemes relieve rental burdens, the pressure on HRA computation can drop for some segments. Conversely, states with active urban migration and limited supply drive up rents and HRA importance for employees.

Success stories: how the monthly HRA calculator helped people

Practical examples show how a reliable hra calculator monthly makes a difference:

- The relocating engineer: An engineer moved from a non-metro posting to Mumbai mid-year. Using a monthly calculator to prorate basic, DA, rent, and HRA, she accurately demonstrated exempt amounts for the two city periods and avoided under-withholding of TDS when switching payrolls.

- The young couple on shared rent: Two professionals sharing a flat used an hra calculator monthly to compute individual exemptions (each declared rent paid to their landlord). Proper documentation and monthly tracking allowed both to reduce their taxable income legitimately.

- Family landlord compliance: An employee paid rent to a parent. By using monthly calculations and maintaining rent receipts and a formal rent agreement, the employee claimed HRA without triggering employer objections — supported by an hra calculator monthly record of payments.

These stories highlight: monthly records, documentation, and transparent calculations reduce disputes and provide credible proof during reviews or audits.

Challenges and common pitfalls

Despite clear rules, HRA claiming and monthly calculation face recurring challenges:

- Incorrect inclusion/exclusion of DA: Some employers and employees are unsure whether Dearness Allowance should be included in salary for HRA calculations. If DA is considered for retirement benefits, it typically forms part of “salary” for HRA calculation; check payroll policy and the employer’s treatment. Use an hra calculator monthly that allows DA inclusion/exclusion to avoid errors. HDFC Life

- Switching tax regimes mid-career: Choosing the new tax regime makes HRA exemption unavailable — employees who previously relied on HRA for tax savings may find their taxable income rising. Before switching, run monthly HRA projections to compare regimes.

- Under-reporting rent or missing PAN: If annual rent to a landlord exceeds ₹1,00,000 and PAN is not provided, the employer may assess different TDS implications. Monthly tracking helps spot such thresholds before the year-end. HDFC Life

- Family rent disputes: Claiming HRA when paying rent to relatives requires immaculate proof. Employers and tax officers may scrutinise transactions that appear nominal or lack bank evidence.

An hra calculator monthly that also generates a download (monthly amortized report) helps mitigate these challenges by producing an auditable monthly statement.

Comparing HRA to other housing-related tax benefits

It is useful to compare HRA with alternatives:

- HRA vs. Home Loan Interest Deduction (Section 24): HRA benefits those who rent; home loan interest deduction benefits those who buy. If you own a house and receive HRA, you cannot claim both HRA and home loan interest on the same house for the same period (except in special circumstances where you live in one property and rent out another). Choosing between HRA and mortgage deductions is a personal finance decision; a monthly HRA projection versus mortgage cashflows helps inform it.

- HRA vs. Section 80GG: If you do not receive HRA from your employer, you may claim deduction under Section 80GG subject to conditions and limits. HRA typically yields greater benefits when employers provide it and proper documentation is available.

- HRA vs. new tax regime: As explained earlier, the new tax regime does not allow HRA exemption. Use monthly calculators to compute taxable salary under both regimes to decide which yields lower overall tax liability. The Economic Times

Payroll implementation: how employers should integrate hra calculator monthly

Employers play a critical role in correct HRA computation:

- Monthly TDS and payroll runs: Payroll systems should incorporate an hra calculator monthly or equivalent module that accepts monthly rent, basic, DA, and HRA to compute taxable HRA for TDS.

- Employee declarations: Employers should collect monthly or periodic rent declarations and rent receipts, with fields for landlord PAN when required.

- Partial-year changes: Payroll must prorate exemption for joiners, leavers, or transfers — an automated monthly tool reduces manual errors and audit flags.

- Record retention: Employers should retain the monthly calculation outputs and proofs as part of compliance files.

Integrated monthly HRA calculators reduce disputes between payroll, employees, and tax authorities.

Technology and products: what to expect from a good hra calculator monthly

A modern hra calculator monthly should provide:

- Inputs for monthly basic, DA, HRA received, monthly rent, and city classification (metro/non-metro).

- Options to treat DA as part of salary (if applicable) and to prorate for partial-year employment.

- A downloadable monthly and annual report showing the three computed amounts, exempt portion, taxable portion, and supporting formula.

- Warnings for compliance triggers (e.g., annual rent > ₹1,00,000 requiring landlord PAN).

- A mobile-friendly UI for employees to keep monthly records and receipts.

- Exportable evidence for payroll and tax return filing.

Many banks, insurers, and tax platforms provide free hra calculator monthly tools; always cross-check calculations with the government HRA calculator when in doubt. Income Tax India+1

Policy framework and social implications: linking HRA to broader goals

HRA sits at the intersection of tax policy and housing outcomes:

- Regional housing affordability: HRA reduces disposable income tax for renters in expensive cities, indirectly supporting mobility to employment hubs.

- Informal rental markets and taxation: Formalising rent payments through declaration and PAN requirements helps bring rental income into tax filings, improving tax equity. The monthly calculation and documentation culture plays a role here.

- Gender and employment: Women who move cities for work (and rent) benefit from HRA; accessible hra calculator monthly tools support financial independence and planning.

- Rural-urban dynamics: Where public housing or employer accommodation is limited in fast-growing towns, HRA helps bridge transitional periods for workers migrating from rural areas.

Policy-makers can monitor aggregated HRA claims to understand urban rental pressures and to design targeted housing schemes or rent support initiatives.

Challenges the system still faces

Despite clear rules, practical difficulties remain:

- Verification of rent payments: Cash rents or informal arrangements make verification hard. Requiring bank transfer records helps but may be impractical in certain markets.

- Landlord compliance: Landlords who receive rent but do not report rental income hinder the tax system. PAN requirements for higher rents aim to reduce non-declaration but are not foolproof.

- Documentation overload: Employers and employees sometimes struggle to maintain monthly receipts, especially when rents are split among roommates or paid in instalments.

- Complexity for part-year cases: Frequent job changes, city transfers, and multiple rentals in a single year complicate monthly exemption calculation — good tools are essential to avoid under/over-claiming.

A standardised hra calculator monthly that is easy to use and integrates with payroll and banking can alleviate many of these frictions.

Best practices for employees using an HRA calculator monthly

- Maintain digital rent receipts: Use bank transfers (NEFT/UPI) where possible and ask for digital receipts every month.

- Use the monthly mode of a calculator: Capture monthly changes (rent hikes, salary changes, transfers) and save monthly reports.

- Check metro classification: Confirm whether your location is treated as a metro for HRA purposes (Mumbai, Delhi, Chennai, Kolkata usually qualify).

- If paying family members, formalise: Create a rent agreement and keep evidence of payments.

- Compare tax regimes: Run your numbers under both old and new regimes before selecting for a tax year.

- Keep landlord PAN when rent > ₹1,00,000: This is a legal threshold and omitting it can complicate compliance.

Using a disciplined hra calculator monthly creates a defensible record and reduces costly errors.

Future prospects: how HRA might evolve

Several trends could influence the future of HRA and the tools used to calculate it:

- Digitisation of rent payments: Wider adoption of digital payments for rent will make monthly verification easier and reduce disputes.

- Integration with ITR filing: Online HRA calculators that seamlessly export into ITR utilities (or vice versa) will simplify claims and make documentation more standardised. The Income Tax Department’s own online HRA calculator and changes to ITR reporting reflect this direction. Income Tax India+1

- Policy reforms: If governments expand rental housing schemes or alter tax priorities, HRA rules may adjust. Continuous monitoring — and recalculating monthly — will help employees adapt quickly.

- AI-driven payroll: Payroll systems may adopt smarter monthly tools that predict tax impacts of rent changes and recommend optimal declarations or regime choice.

In short, the combination of policy clarity and technology will make the hra calculator monthly an even more central planning instrument.

Practical checklist: using an hra calculator monthly effectively

- Gather monthly payslip (basic and HRA), monthly rent receipts, and landlord PAN if needed.

- Decide whether DA is part of “salary” for your case and enter it.

- Enter metro vs non-metro city classification.

- Run both monthly and annual modes to check exemptions and taxable amounts.

- Save monthly reports and annex them to your employer’s declaration or annual tax file.

- Re-run the calculator if you change apartments, salary, or tax regimes mid-year.

Common myths and clarifications

- Myth: HRA is always fully tax-free.

Reality: Only the least of the three formula components is exempt; often part of HRA is taxable. Use an hra calculator monthly to discover the precise split. ClearTax - Myth: You cannot claim HRA if you live with parents.

Reality: You can claim HRA if you pay rent to your parents and maintain documentation proving genuine rent payments and a formal arrangement. - Myth: HRA is allowed under the new tax regime.

Reality: HRA exemption is not permitted under the new tax regime; the decision to choose the new or old regime should be informed by monthly tax projections. Income Tax Department

Comparison: top features to expect from competing HRA calculators

When selecting an hra calculator monthly, evaluate features such as partial-year prorating, DA inclusion toggle, compliance warnings for rent > ₹1,00,000, downloadable monthly amortization reports, and mobile accessibility. Official government tools provide accurate formulae; many private platforms add user experience and payroll-friendly exports.

How to run your own safe monthly HRA audit (step-by-step)

- Export 12 months of rent receipts and bank statements.

- Export or collate monthly payslips (basic, DA, HRA).

- Run an hra calculator monthly with exact monthly inputs; save the monthly reports.

- Reconcile the calculator’s exempt amounts with employer’s tax-exempt HRA entries in Form 16 or payslips.

- If discrepancies exist, raise with payroll and retain the calculator output and receipts as evidence.

A documented monthly calculation makes audits straightforward and defensible.

Final thoughts: why you should adopt monthly HRA calculation now

Monthly computation and documentation resolve timing mismatches, reduce year-end surprises, and empower employees to make informed regime choices. Whether you are a payroll manager implementing compliant TDS runs or an employee planning finances, a robust hra calculator monthly should be part of your toolkit. It saves time, reduces risk, and gives you a repeatable record — exactly what modern tax compliance demands. For reliable calculation, start with the official Income Tax HRA calculator and test results against reputed private calculators for UX and reports. Income Tax India+1

Frequently Asked Questions (FAQs)